Fannie Mae 1038 2014-2026 free printable template

Show details

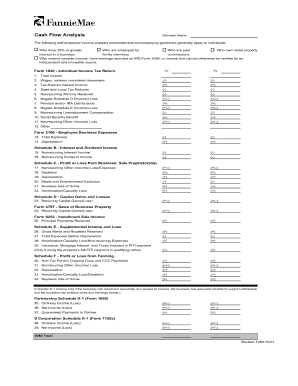

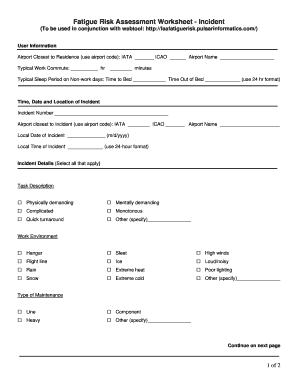

Rental Income Worksheet Individual Rental Income from Investment Property s Monthly Qualifying Rental Income or Loss Investment Investment Property Documentation Required Property Address Address Schedule E IRS Form 1040 OR Enter Lease Agreement or Fannie Mae Form 1007 or Form 1025 Step 1. When using Schedule E determine the number of months the property was in service by dividing the Fair Rental Days by 30. If Fair Rental Days are not reported the property is considered to be in service...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign fnma rental income worksheet form

Edit your fannie mae self employed income worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fannie mae income calculator form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fannie mae income worksheet online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fannie mae form 1038. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 1038

How to fill out Fannie Mae 1038

01

Obtain the Fannie Mae 1038 form from the official Fannie Mae website or your lender.

02

Fill in the borrower information, including the name, address, and Social Security number.

03

Provide details about the loan type and amount.

04

Include information about the property, such as the address and property type.

05

Indicate the purpose of the loan (e.g., purchase, refinance).

06

Complete the underwriting information, including credit scores and debt-to-income ratios.

07

Review all entered information for accuracy and completeness.

08

Sign and date the form where required.

09

Submit the completed form to the appropriate lending authority.

Who needs Fannie Mae 1038?

01

Borrowers seeking financing for a home purchase or refinancing.

02

Real estate agents assisting clients with transactions requiring mortgage financing.

03

Lenders processing mortgage applications through Fannie Mae.

Fill

fnma income worksheet

: Try Risk Free

People Also Ask about 1038 form

What deductions can be added back to income?

Items that can be added back to the business cash flow include depreciation, depletion, amortization, casualty losses, net operating losses, and other special deductions that are not consistent and recurring.

What is the Form 1084?

This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes.

How does Freddie Mac calculate income?

Multiply the 52-week average stock price as of the Application Received Date by the number of vested shares distributed (pre-tax) to the Borrower in the past year, then divide by 12. Use the total dollar amount distributed (pre-tax) from the cash equivalent of vested shares in the past year and divide by 12.

What all deductions can be claimed in income tax?

Below is the complete list: Public Provident Fund. National Savings Certificate. National Pension Scheme. Employees' Provident Fund. Tuition fees. Post Office tax-saving deposits. Five-year bank deposit. Life Insurance Premium.

How do you calculate self employed borrower income?

How is self-employment income calculated? Self-employed individuals typically submit income tax forms to document their income for a mortgage loan. The lender will then average income over the past two years and divide that annual income by 12 to come up with an average monthly income.

What can you add back in for self employed income?

Adjustments to Income: Most of the income adjustments shown in IRS From 1040 must be added back to adjusted gross income. These adjustments include IRA deductions, the self-employed health insurance deduction, Keogh retirement plans, penalties on early withdrawal of savings, and alimony paid.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get fannie mae 1038?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the fnma form 1038 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I complete fannie mae self employment worksheet on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your fannie mae schedule c income worksheet by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Can I edit fannie mae rental income worksheet on an Android device?

You can make any changes to PDF files, like fnma self employed income worksheet, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is Fannie Mae 1038?

Fannie Mae 1038 is a form used by lenders to report certain mortgage-related information to Fannie Mae, particularly in relation to loan deliveries and servicing.

Who is required to file Fannie Mae 1038?

Lenders that sell or service loans on behalf of Fannie Mae are required to file the Fannie Mae 1038 form.

How to fill out Fannie Mae 1038?

To fill out Fannie Mae 1038, lenders must provide detailed information about the loans, including borrower details, loan amounts, loan types, and other relevant data as specified by Fannie Mae guidelines.

What is the purpose of Fannie Mae 1038?

The purpose of Fannie Mae 1038 is to ensure accurate reporting and tracking of mortgage loans that are being sold to or serviced by Fannie Mae, helping maintain regulatory compliance and data integrity.

What information must be reported on Fannie Mae 1038?

Information reported on Fannie Mae 1038 includes the loan number, borrower name, loan amount, property address, loan type, origination date, and servicing details, among other data points.

Fill out your Fannie Mae 1038 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fannie Mae Income Calculation Worksheet is not the form you're looking for?Search for another form here.

Keywords relevant to fannie 1038

Related to self employed borrower worksheet

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.